Homeowners solar companies and industry advocates alike were given a big christmas gift in 2015 when congress approved the 2016 federal spending bill and extended the solar panel tax credit.

California solar panel tax credit 2020.

How much is the california solar tax credit in 2020.

Federal solar tax credit.

Solar power in california used to qualify for a tax credit.

These rebates can pay solar shoppers anywhere from 500 total to 0 95 per watt of installed capacity.

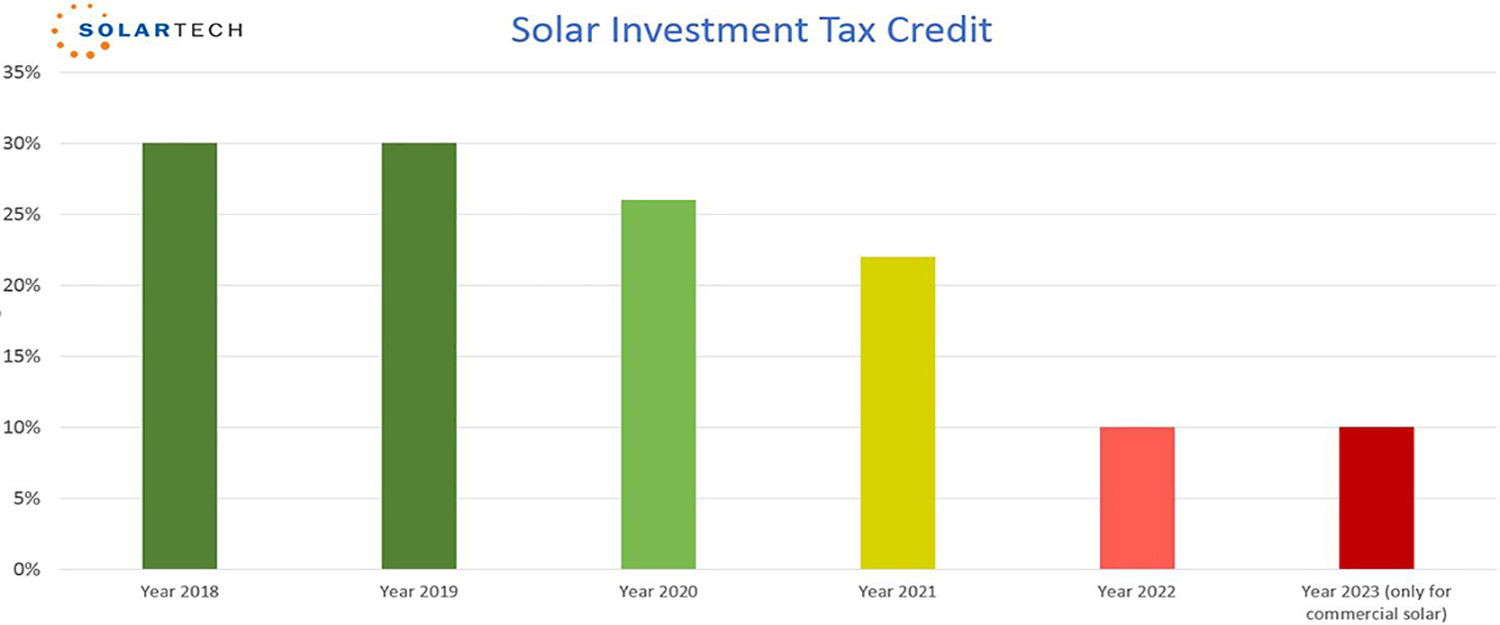

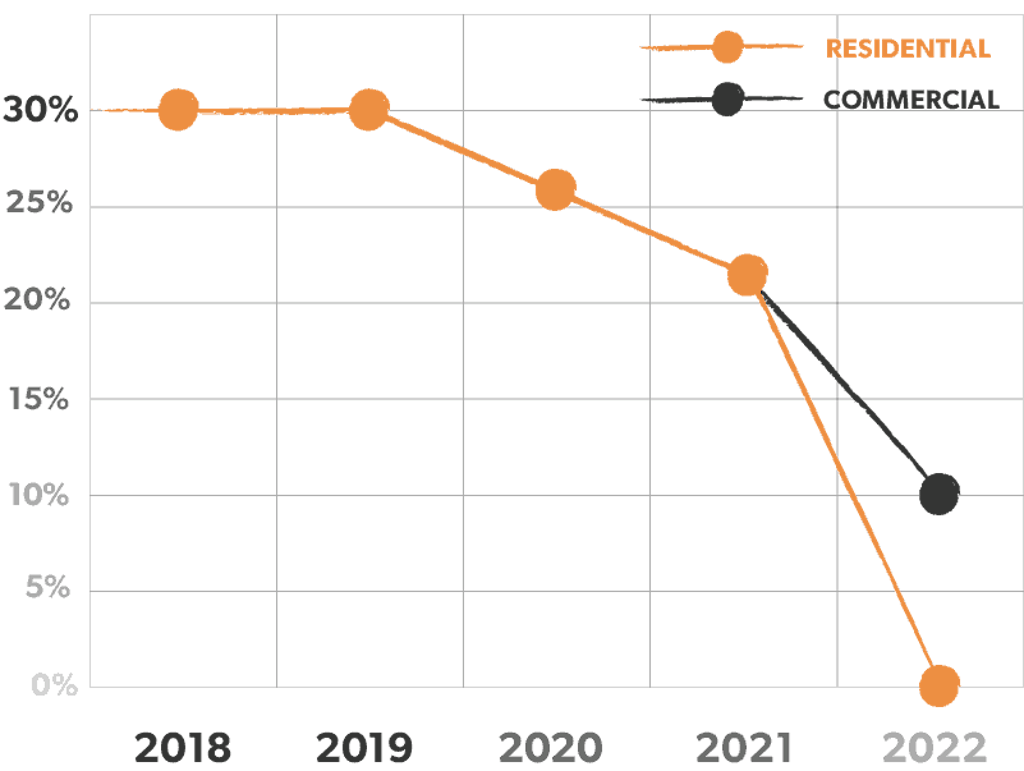

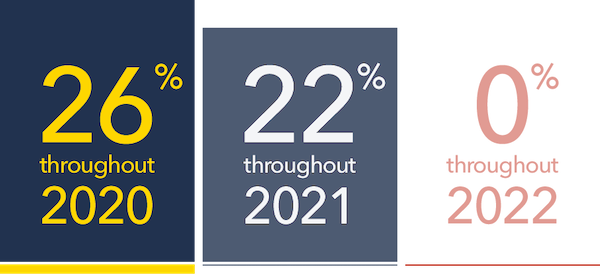

At the end of 2020 the amount of the credit will fall to 22.

Right now the federal tax credit is equal to 26 of the total installed costs of installing a solar system.

However community solar programs can be structured in various ways and even if you are eligible for the tax credit it may.

Sadly the solar tax credit went the way of the dodo bird in 2005.

The most significant incentive to install solar panels for homes and businesses is the federal tax credit.

To be fair the tax credits were probably allowed to expire because of the implementation of the huge csi program and all those solar rebates we just talked about.

Check out our top list of incentives to go solar in california.

There is no california solar tax credit.

12 that means if you purchase a 6 kilowatt system for 18 300 you ll pay 12 810 after you receive your tax credit.

Here are just two.

Ensure you receive the full 26 solar tax credit and additional incentives for going solar in 2020.

The residential renewable energy tax credit as the irs calls it can be an attractive way to save on the significant cost of installing solar panels or roofing an average sized residential solar.

The december 18 bill contained a 5 year solar tax credit extension which makes solar energy more affordable for all americans.

What are the main california solar tax credits and rebates.

The federal solar tax credit is 26 of the cost of a system in 2021.

Homeowners have access to rebate programs in many areas of the golden state.

This credit has no limit meaning you can claim up to 26 percent of the cost of any qualifying solar panel system purchase no matter how much it costs however after 2020 is over the tax credit decreases each year and will be completely gone by the end of 2022.

The federal solar tax credit is scheduled to step down to 26.

Tax credits13 that off site solar panels or solar panels that are not directly on the taxpayer s home could still qualify for the residential federal solar tax credit under some circumstances.